Depending on who you listen to, it is always either a very good or a very bad time to invest in Bitcoin. The currency has either already peaked, or is about to go through a price surge. Many of the people who profess to be ‘experts’ on the topic of the world’s most famous cryptocurrency have been left with egg on their faces in the past after making bold predictions about the coin’s performance (or lack of), and more will suffer the same fate in future.

By this point, it might be a better idea if we all accept that nobody really knows what Bitcoin is going to do next, and it’s every bit as unstable an investment as it is exciting. Despite that, we’re going to try to make sense out of its latest movements in this article.

If anything sums up Bitcoin’s erratic behavior, it is the first 48 hours of September. The currency started the month by breaking through the $12,000 barrier, and then suffered its largest one-day dip for well over a month, dropping just under 7% to $11,187. At the time of writing, it's fallen even further than that, standing at $10,812. We appreciate that by the time you read this - which, if we have got our timings right, will be within 24 hours of this article being written - the value may have changed again. It might have shot back up, or it may have fallen further.

That is the problem with Bitcoin. You never quite know what you're going to get, and even when you get it, you're never quite sure why it is happened. In 2023 it has been fluctuating in price between $17,000 and $22,000 so far.

All of this makes it very difficult to operate as a Bitcoin trader or investor. Successful traders instinctively know when a price is good, and they sell at that price to make the most out of their holdings. They also know when a price has bottomed out, and will buy heavily at that point so they can sell for a profit at a later date. It is impossible to do that with Bitcoin. People like to pretend otherwise, but in real terms investing in Bitcoin is about as reliable a method of making money as pouring your savings into an Online Slots UK and hoping for the best. The machinations that drive the performance of Bitcoin are every bit as unknowable (and occasionally frustrating) as the mathematics that govern the likelihood of an online slots win, and you have just as little control over how they work.

The only reliable way to make money out of online slots is to buy an online slots website. The only reliable way to make money out of currency trading is to invest in a predictable currency. Bitcoin doesn’t fit that description.

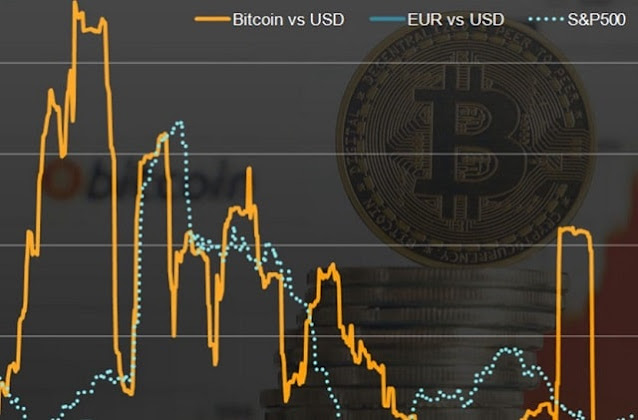

One of the first things that people look at when Bitcoin loses momentum or starts to struggle is the value of the world’s major currencies, and specifically the dollar. History tells us that when the dollar performs well, Bitcoin weakens. There might be something to say for that idea with this latest sudden rise and fall. The dollar has started the month very well, and some investors will have chosen to jump aboard that rise at the expense of their cryptocurrency holdings.

A closer look at the data we have available, however, shows that there's a more specific trend going on. Retail investors are abandoning Bitcoin in bigger numbers than any other type of investors, and it's that abandonment that's softening Bitcoin's performance. There must be a reason behind that sector's decision to effectively up sticks and leave, but not one that we can currently ascertain.

We've seen some reporting that suggests that Bitcoin's (comparative) woes are down to Ethereum gaining a greater foothold in the crypto market among concern that Bitcoin has become "too mainstream" and no longer represents the ideals that cryptocurrencies were designed to uphold. Ethereum, very slightly, up. That doesn't reflect a trend across all cryptocurrencies, though. Bitcoin Cash and Ether both fell sharply in the same timeframe as Bitcoin.

The Bloomberg Galaxy Crypto Index, one of the very few tools by which the performance of cryptocurrencies can be accurately measured as a group, has dropped by almost ten percent. Clearly, this isn't exclusively a Bitcoin thing; it's a cryptocurrency in. Ethereum might be exempt from the trend for now, but correlation is not causation. Ethereum isn't gaining from the losses of other cryptocurrencies.

As you’ve probably noted by this point, the general tone of this perspective is doom and gloom. It is hard to escape that perspective when, once again, Bitcoin has tripped over itself and disappointed investors just as it appeared to be heading in the right direction again. We don’t like to leave things on a sour note, though, so we might be able to offer a sliver of hope to those of you who have Bitcoin holdings and don’t intend to cash them in or otherwise dispose of them any time soon.

Fidelity Investments, one of the most trustworthy names in the whole industry, has launched a Bitcoin fund for the first time within the past seven days. We won’t pretend to know as much about the market - or about anything - as Fidelity Investments does. If they see enough value to enter the fray, we suspect that they know something that we don’t. We will also point out that even with this most recent price crash, Bitcoin is still at its highest level for around twelve months. After a year of mostly dreadful performance, it’s back to where it was last September.

We don't know where Bitcoin is going to go from here, and we suspect that anyone who tells you that they do is probably a liar. We realize that it might have jumped up above $13,000 by the time you read this, and we might sound foolish as a result. Even if it has, though, it is just as likely to drop back to $10,000 in a few days' time as it is to reach $15,000, and nobody will fully understand the whys and wherefores of either situation should they happen.

Investing in Bitcoin will always be as much about the thrill of the chance at earning a sudden fortune as it is about seriously expecting a return. So long as you are happy to accept the cryptocurrency risks, invest away and hopefully you will avoid a Bitcoin bubble pop in 2023 or 2024!